Navigating the landscape of taxes can be challenging, but for seniors 65 years and older, there may be some relief in the form of property tax exemptions.

These exemptions are critical for many seniors living on fixed incomes, as they can significantly reduce the annual property tax burden on their homes.

Property tax exemptions for seniors vary widely depending on the state and locality, recognizing the value and contribution of older citizens by lessening their financial burden during retirement years.

Key Takeaways

Property Tax Exemptions

Property tax exemptions for seniors can offer significant savings, reducing the financial burden during retirement.

Definition and Purpose

Property tax exemptions serve to lower the amount of property tax you owe on your primary residence. The purpose of these exemptions is to provide financial relief, especially for those on a fixed income after the age of 65. These exemptions recognize the valuable contribution seniors have made to society and aim to help them manage living costs as they age.

Eligibility Criteria for Seniors Over 65

To be eligible for a property tax exemption as a senior, you typically must:

- Be at least 65 years old.

- Own and occupy your home as your primary residence.

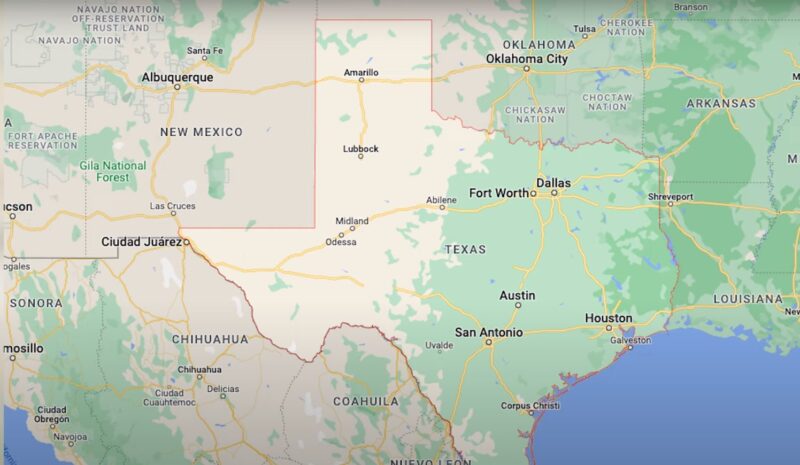

Some localities might require that you’ve owned your property for a minimum period. The exact details can vary by state and local jurisdiction. For instance, New York’s senior exemption is calculated at 50 percent of your home’s appraised value. In Texas, seniors may qualify for a $10,000 exemption from school district taxes. It’s important to check your local assessor’s office for specific details in your area.

Types of Property Tax Exemptions for Seniors

Property tax exemptions can significantly reduce the amount you owe on your home if you are over 65. These exemptions vary by state and local jurisdiction, but there are common categories that provide relief.

Homestead Exemption

Your primary residence may be eligible for a Homestead Exemption, which can offer reductions or waivers on property taxes. In states like Texas, you can receive an additional $10,000 exemption if you’re 65 or older, which is added to the standard exemption amount available to all homeowners.

Senior Citizens Exemption

Many states offer a Senior Citizens Exemption specifically targeted at homeowners above a certain age threshold. This exemption often hinges on income criteria, ensuring that it supports those senior citizens with a need for financial aid. New York, for example, provides a property tax exemption for seniors that scales based on income levels and may require annual renewal by a specific deadline.

Disabled Persons Exemption

If you are both a senior and a disabled individual, you might be eligible for a Disabled Persons Exemption. States can offer unique exemption amounts just for residents who meet the criteria of being over a certain age and having a disability. Several senior homeowner exemptions overlap with those offered to disabled residents, such as property tax breaks that help them maintain homeownership.

How to Apply for Exemptions

When applying for property tax exemptions as a senior, you need to navigate the application process, meet specific requirements, and have certain documents on hand.

Application Process and Requirements

You must file your exemption application with your local appraisal district. The general deadline is typically before May 1st of the tax year. For instance, in Texas, school districts require an additional exemption for those age 65 or older or disabled. Be prepared to prove your eligibility based on age or disability.

Necessary Documentation

To successfully apply for a property tax exemption, you’ll need to provide:

- Proof of age or disability status, such as a driver’s license or doctor’s statement.

- Evidence of homeownership, like a deed or title.

- Additional forms as required by your specific locality or state, which can include details on income and residency.

Challenges and Considerations

When seeking property tax exemptions as a senior, it’s crucial to stay informed on the laws and tax implications that can affect your finances and the benefits you’re eligible for.

Navigating Changes in Property Tax Laws

Understanding the shifting landscape of property tax laws is key to maximizing your exemptions. With changes often rooted in legislative updates, it’s important to regularly check for any alterations in the rules that apply to the senior property tax exemption. This might involve reading up on recent legislation or seeking advice from tax professionals.

Understanding Tax Implications

The tax benefits afforded to you as a senior can have significant implications on your overall financial health. For example, an additional $10,000 exemption against school district taxes can lead to considerable savings. However, you’ll need to apply for these benefits, as they are not automatic. Ensure you understand the eligibility requirements and the application process to take full advantage of the tax breaks you’re entitled to.

State-Specific Information

Property tax exemptions for individuals over 65 years old can significantly reduce your tax burden, but the benefits and requirements vary from state to state. Understanding the specific exemptions available in your area is essential for taking full advantage of these programs.

Variations in State Exemptions

In Alabama, Alaska, Florida, and South Dakota, you can find programs that may eliminate your property tax payments entirely if you meet certain criteria, such as age and income thresholds. For instance, Florida offers additional homestead exemptions for seniors aged 65 and older, which can be applied for through your county’s property appraiser’s office.

In contrast, states like Georgia and Mississippi also offer programs for seniors that can reduce or totally remove the property tax obligation. It’s important to note that some states, like New York, might allow a surviving spouse to claim the exemption if their partner was over 65 at the time of their passing.

Contacting Local Tax Authorities

To ensure an accurate understanding of your eligibility for tax exemptions, contact your local tax authority. They can provide the most up-to-date information on the exemptions available to you and assist with the application process.

Frequently Asked Questions

In this section, we address common inquiries regarding property tax exemptions for seniors, providing clarity on how to apply, eligibility criteria, variance across states, necessary documentation, and how these exemptions intersect with other tax relief initiatives.

How can seniors apply for property tax exemptions?

To apply for a property tax exemption, you typically need to submit an application to your local tax assessor’s office. Some jurisdictions may even allow online submissions. Details on the process can often be found on relevant government websites.

What qualifications are necessary for a senior to receive a property tax exemption?

The primary qualification for a senior property tax exemption is age, generally being 65 years or older. Residency, property ownership status, and income levels can also be factors, depending on your state or local jurisdiction.

Are property tax exemption amounts for seniors standardized across states?

Amounts are not standardized—property tax exemption amounts for seniors vary significantly between states and sometimes within them, at the county or municipal level.

What documentation is required when a senior citizen applies for a property tax exemption?

When applying, you will likely need to provide proof of age, such as a government-issued ID, proof of residency, and sometimes income verification or a death certificate if the exemption is based on a deceased spouse’s age.

How does reaching the age of 65 impact property tax obligations?

Reaching the age of 65 can lead to reduced property tax obligations through exemptions that lower the taxable value of your property or freeze the tax rate.

Can property tax exemption benefits for seniors be combined with other tax relief programs?

In many cases, you can combine senior property tax exemptions with other relief programs, such as homestead exemptions or disability-related tax relief, for added benefits. Check with your local taxing authority to understand the rules that apply to combining tax benefits.

Conclusion

For seniors 65 and older, navigating the complexities of property taxes can uncover valuable exemptions that significantly reduce their financial burden. These exemptions, varying widely by state and locality, are designed to recognize the contributions of seniors by offering them relief during their retirement years.

Understanding and applying for these exemptions requires awareness of specific eligibility criteria, submission deadlines, and the necessary documentation. By staying informed and proactive, seniors can take full advantage of these benefits to ease their property tax obligations.